Stocks Technical Analysis Trendlines

Definition

Technical analysis is built on the assumption that prices trend. A trendline is a straight line that connects two or more price points and then extends into the future to act as a line of support or resistance.

Figure 4.17: Uptrend and downtrend lines.

An uptrend line (figure 4.17) has a positive slope and is formed by connecting two or more low points. Uptrend lines act as support. As long as closing prices remain above the trendline, the uptrend is intact.

A break below the uptrend line indicates a change in trend for the period being considered. In LOCKIT a stock price closing below the uptrend line is a selling signal.

A downtrend line (figure 4.17) has a negative slope and is formed by connecting two or more high points. Downtrend lines act as resistance. As long as closing prices remain below the downtrend line, LOCKIT considers the downtrend intact.

A break above the downtrend line indicates a change of trend for the period being considered. A price closing above the downtrend line is a buying signal.

One or more big up or down bars at a reversal point (figure 4.18) may be the reason that it is difficult to draw a new trendline from the highest or lowest point.

Figure 4.18: Trendline with big bar at the reversal point.

In the chart, you mostly will see a sharp V-pattern or, at least, that the last up- or down-move was very big, eventually with a bigger window (figure 4.19).

Ninety-nine percent of the time, the move that follows will not be as steep as the new trend start.

In these circumstances, the new downtrend or uptrend line will have to start with one of the previous or following bars, or at some previous support or resistance level.

A 20 period’s exponential moving average or a last pitchfork is generally a good indication for the expected trendline inclination.

Figure 4.19: V-reversal pattern.

Stocks Technical Analysis Trendlines

Trendline Evolution

A medium to longer term uptrend or downtrend not always evolutes the same way. Looking at different charts and periods we noticed that from the start of a new price move, the trend shows three possible scenarios before reaching the end of that trend:

- No change; the price continues to move along the trendline until it breaks the trendline.

- The price accelerates and moves far away from the trendline; you need to draw a new, steeper trendline.

- The price decelerates and breaks the trend moderately and continues, temporarily, less steep or even flat.

- Of course in some longer term price moves you will find all three possibilities combined in one trend.

No Change

If there’s no change (figure 4.21), the trendline stays intact during the whole up- or down-move.

When the trendline is broken, it is the start of a new trend in that specific time period.

It is rather uncommon that there is no change.

Medium- and long-term moves will show most of the time a change in trend acceleration.

Figure 4.21: No change in trendline evolution.

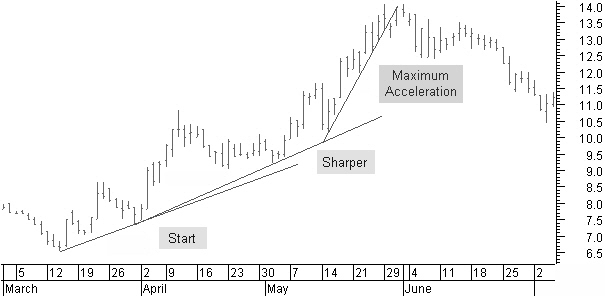

Accelerating

Price acceleration often is a three-step process (figure 4.22). The trend is broken after the third change in acceleration, when it has become a very sharp move.

Figure 4.22: Trendline acceleration.

Later when we talk about price chart patterns, you will see that these changes in acceleration often are announced by a price continuation pattern.

Slowing Down

A longer-term uptrend starting with a sharp up-move will generally slow down.

Figure 4.23: Trendline deceleration.

In figure 4.23, you can see how short-term reactions against the main trend will slow down the up-move. A longer-term flatter price channel is formed.

The S&P500 index in figure 4.23 gives a buy signal at the end of October 2004 when the closing price moves above the downtrend line. The price takes off with high acceleration. It is clear that this cannot be sustained for a long period of time.

The price continues to move higher, but not at the beginning speed. So when this sharp trendline is broken, do we have to close the position?

Because of the previously high acceleration, you should leave enough room for the price to slow down. For example, you can use a support line or a trailing stop level to allow this process

Most of the time, the trailing stop will not be broken if the price continues to move higher.

After some time you can draw a flatter trendline followed by a steeper trendline, as is the case here. You can of course, also adapt the slope from the start (dotted trendlines) to represent the new longer-term trendline.

Stocks Technical Analysis Trendlines

Special Trendlines

Inverse Trendline

Inverse Trendline

Sometimes it may seem difficult to start drawing a normal trendline.

In figure 4.24, the move starts with a sharp trendline up.

Next, the prices slow down for a short time; then subsequently continue with high acceleration.

In such a scenario, it is difficult to draw a trendline or price channel that would help to estimate future price targets.

Figure 4.24: Inverse trendline.

This is where the inverse trendline comes in handy. The last price high in September and a previous end of July high pivot are good reference points for drawing the inverse thick trendline in figure 4.24. In an ascending trend, the inverse trendline is drawn from price tops. In a descending trend, the inverse trendline is drawn from price bottoms.

From the lowest bottom in August, you now can draw a parallel line with the inverse trendline, creating the other side of what probably will become a future price channel.

Figure 4.25: Inverse trendline evolution.

Figure 4.25 shows the further price evolution perfectly in line with the trend channel created on the base of the inverse trendline. Sometimes you will see a normal downtrend line and an inverse trendline that have different slopes.

Figure 4.26: Normal and inverse trendline.

As you can see in figure 4.26, the prices touch both the inverse trendline and the parallel line. The parallel line with the inverse trendline from the start of the downtrend forms a multi-reversal line that alternates between resistance and support. It also looks as if the downtrend channel is widening.

Figure 4.27: Normal and inverse trendline evolution.

Looking at the further price development in figure 4.27, it is funny to see how each of the trendlines does the job. The inverse trendline gives support, just like the multi-reversal line does, while the normal downtrend line is now resisting.

The inverse trendline is a good tool to find medium and longer term trends when it is not possible to draw a normal trendline in the early stage of a new trend development.

Stocks Technical Analysis Trendlines

Centerline

The centerline is drawn between a bottom pivot point and a top pivot point or visa versa. This kind of trendline can be used as a reference for action-reaction lines.

Figure 4.28: Centerline.

In figure 4.28, a parallel line with the centerline through a previous high or low point is the action reference. Preferably, the action line and the price data should show a similar slope.

From here on, you can create a second parallel line; this is the reaction line projected into the future. The distance from the centerline is equal to the distance between the centerline and the action line.

Note how the prices turn at the reaction line and how they start moving up again with about the same slope as the original top-bottom centerline.

Multi-reversal Line

A multi-reversal line touches the bottoms as well as the tops of the price bars. Multi-reversal lines are mostly used as a reference for action/reaction lines but also for future support or resistance in relation with future price projections.

Figure 4.29: Multi-reversal line.

In figure 4.29, look at how multi-reversal lines show support and resistance to future price movement. Multi-reversal lines complement price targets, since they can be used as reference for future price support and resistance.

Note how all multi-reversal lines are close to the $25 target given by a Fibonacci projection (dashed horizontal line). This gives a good time estimate as to when this first Fibonacci target can be reached.

The centerline and multi-reversal line are most useful finding targets both price and time related.

Stocks Technical Analysis Trendlines

Trend Channels

Trend channels are parallel lines containing a smaller or larger price move. The unparallel lines of a triangle formation also are a trend channel. Trend channels represent support and resistance and can be used within LOCKIT to find price targets.

Parallel Trend Channels

Let’s look at the trend channels in figure 4.30, a chart with weekly price data.

Figure 4.30: Trend channels.

- A trendline A is formed by a range of higher low points. A parallel line B to the upper part of the prices is the start of what will become the upper side of a long-term trend channel.

- The price falls through trendline A and consolidates in a horizontal to slightly decreasing trend channel D.

- The consolidation period finishes with a price jump out of channel D and forms a strong rising channel E. This uptrend finishes at the resistance of the upper side of the long-term trend channel B.

- The parallel line C with the long-term trendline B at the bottom of channel D creates the lower part of the broad channel BC. Falling through this trendline in the future will probably be the start of a larger, long-term correction.

- The price falling out of channel E makes up the lower part of channel F, a narrower trend channel within the large trend channel with the same slope.

- Leaving channel F we get a high accelerating rising channel G a fraction beyond the upper part of the broad channel, but returning back fast inside the long-term channel.

- What follows is an equally fast move down with channel H, until reaching the lower part of the long-term broad channel BC.

As long as a channel is valid, the price is moving between the extremes of that channel. The price reaching the upper part or the lower part of a trend channel is, therefore, not only a buying or selling signal, but also a good indication of what price level can be reached in the future.

Triangle Trend Channel

We also consider a triangle formation as a trend channel.

In figure 4.31, there is an uptrend line between March and April. The resistance line from the top at the beginning of March is broken in April with a rising window, but the price falls back below this resistance line, turning it into a support line by the end of April. A couple of days later, the resistance line is broken again.

In figure 4.31, there is an uptrend line between March and April. The resistance line from the top at the beginning of March is broken in April with a rising window, but the price falls back below this resistance line, turning it into a support line by the end of April. A couple of days later, the resistance line is broken again.

The price develops lower tops and higher bottoms; the result is a symmetrical triangle formation.

A triangle formation is a continuation pattern, but it also can be a reversal pattern. The direction of the price will be clear only after the price breaks out of the pattern, either to the upper or the lower site of the triangle. Most of the time, the triangle is a continuation pattern, and the price will continue to move in the direction of the previous trend.